Siddhant Mohite, Mumbai Uncensored News:

हैदराबादचा रहिवासी असलेला साजिद अक्रम आणि त्याचा मुलगा नवीद यांनी ऑस्ट्रेलियातील बाँडी बीचवर गोळीबार केला. या हल्ल्यात १५ जणांचा मृत्यू झाला असून, ४० जण जखमी झाले आहेत.

‘बाँडी बीचवरील गोळीबार हा हल्लेखोरांनी ‘इस्लामिक स्टेट’पासून (आयएस) प्रेरित होऊन केलेला दहशतवादी हल्ला होता,’ असे ऑस्ट्रेलियाच्या फेडरल पोलिस आयुक्त क्रिसी बॅरेट यांनी मंगळवारी सांगितले. ‘हल्लेखोरांच्या गाडीत ‘आयएस’ चे झेंडेदेखील सापडले,’ असे पंतप्रधान अँथनी अल्बानीज यांनी या वेळी नमूद केले.

ऑस्ट्रेलियातील प्रसिद्ध बाँडी बीचवर गोळीबार करणारा हल्लेखोर साजिद अक्रम हा मूळचा हैदराबादचा रहिवासी होता. तेलंगण पोलिसांनी मंगळवारी ही माहिती दिली. हैदराबादमध्ये पदवीपर्यंतचे शिक्षण घेतल्यानंतर साजिद नोव्हेंबर १९९८मध्ये रोजगाराच्या शोधात ऑस्ट्रेलियाला स्थलांतरित झाला. मात्र, तो हैदराबादमधील नातेवाइकांशी संपर्कात होता.

बाँडी बीचवर हनुक्काउत्सवादरम्यान केलेल्या बेछूट गोळीबारात १५ नागरिकांचा मृत्यू झाला होता. मृतांमध्ये १० ते ८७ वर्षे वयोगटातील लोकांचा समावेश होता. या हल्ल्यात ४० जण जखमी झाले. यातील २५ जणांवर अद्यापही उपचार सुरू असून, दहा जणांची प्रकृती चिंताजनक आहे. ५० वर्षीय साजिदआणि त्याचा २७ वर्षीय मुलगा नवीद यांनी हा गोळीबार गेल्याचे समोर आले आहे. पोलिसांच्या गोळीबारात साजिद ठार झाला, तर जखमी नवीदवर उपचार सुरू आहेत.

भारत आणि मुंबईसाठी सुरक्षाविषयक परिणाम: वाढती चिंतेची बाब

जरी हा दहशतवादी हल्ला ऑस्ट्रेलियात झाला असला तरी, त्यामुळे आपल्या देशातील अंतर्गत सुरक्षेतील त्रुटींबद्दल पुन्हा एकदा गंभीर प्रश्न निर्माण झाले आहेत—विशेषतः मुंबई शहराबद्दल, जे भूतकाळात अनेकदा दहशतवादी हल्ल्यांचे लक्ष्य ठरले आहे.

सध्या मुंबईत बांगलादेशी आणि रोहिंग्या घुसखोरांच्या संख्येत झपाट्याने वाढ होत आहे. रस्त्यांवरील भाजीपाला आणि फळांच्या गाड्यांपासून ते शॉर्माच्या दुकानांपर्यंत, खाद्यपदार्थांच्या गाड्यांपर्यंत, मांस आणि मासे विक्रेत्यांपर्यंत, त्यांची उपस्थिती संपूर्ण शहरात अधिकाधिक स्पष्टपणे दिसून येत आहे.

यामुळे मुंबईकरांसमोर काही आवश्यक प्रश्न उभे राहतात: आपल्या ओला-उबर टॅक्सी चालवणारे हे लोक कोण आहेत? स्विगी आणि झोमॅटोसाठी काम करणारे डिलिव्हरी बॉईज कोण आहेत? अर्बन कंपनीमार्फत दुरुस्ती, साफसफाई किंवा इन्स्टॉलेशनसाठी आपल्या घरात येणारे पुरुष कोण आहेत?

ते पडताळणी केलेले भारतीय नागरिक आहेत की, बनावट आधार कार्ड आणि खोट्या कागदपत्रांच्या आधारे शहरात राहणारे अवैध घुसखोर आहेत?

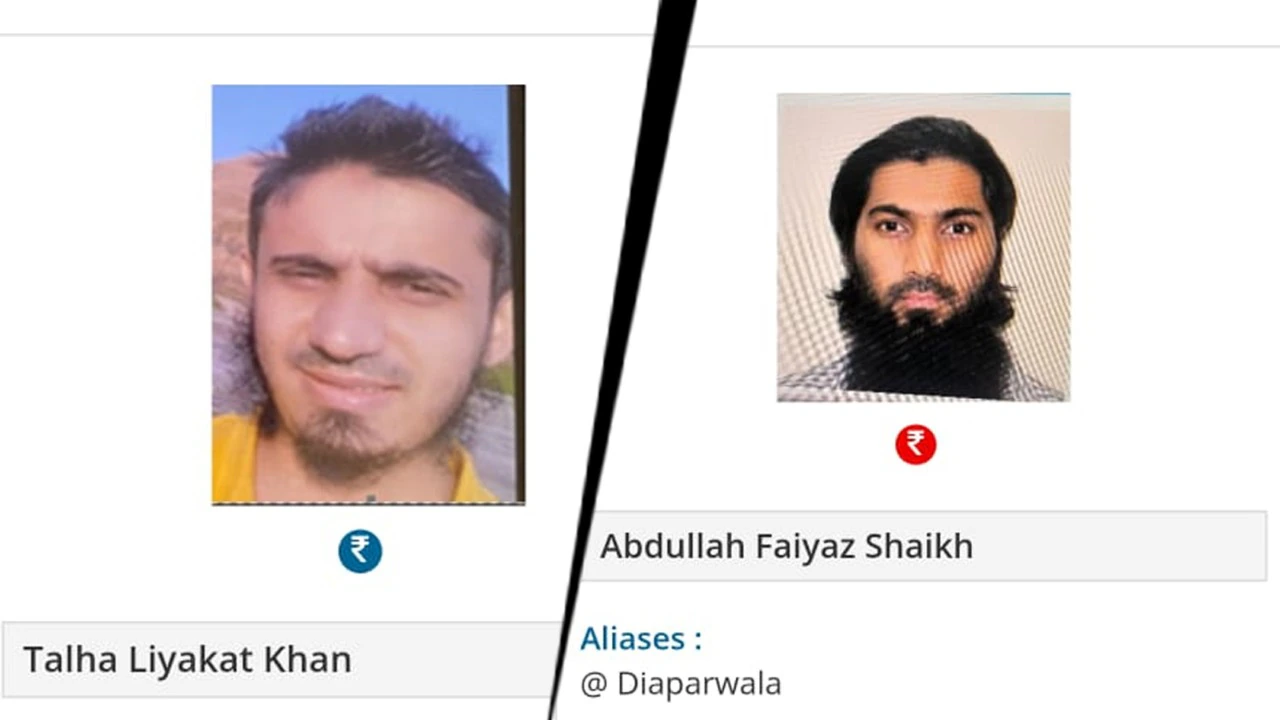

सुरक्षा तज्ञांनी इशारा दिला आहे की, अनियंत्रित अवैध स्थलांतरामुळे अंतर्गत सुरक्षेला संभाव्य धोका निर्माण होतो. ही चिंता केवळ अवैध वास्तव्याबद्दल नाही, तर दहशतवादी संघटना अशा नेटवर्कचा वापर लॉजिस्टिक्स, निधी, आश्रय किंवा स्लीपर सेलसाठी करण्याची शक्यता आहे.

बॉन्डी बीचवरील दहशतवादी हल्ला ही एक गंभीर आठवण आहे की, कट्टरतावाद लोकांच्या नजरेपासून दूर, अनेक दशके शांतपणे वाढू शकतो. मुंबईत प्रचंड लोकसंख्या, आर्थिक महत्त्व आणि कमकुवत पडताळणी यंत्रणांमुळे, आता नागरिकांना अधिक सावध राहणे गरजेचे आहे.

शहराची सुरक्षा धोक्यात येणार नाही याची खात्री करण्यासाठी अधिकाऱ्यांनी तातडीने पार्श्वभूमी पडताळणी, कागदपत्रांची तपासणी आणि विविध संस्थांमधील गुप्तचर माहितीची देवाणघेवाण मजबूत करणे आवश्यक आहे.

Special Editions2 months ago

Special Editions2 months ago

Special Editions2 months ago

Special Editions2 months ago

Special Editions2 months ago

Special Editions2 months ago

Special Editions4 weeks ago

Special Editions4 weeks ago

Special Editions4 weeks ago

Special Editions4 weeks ago